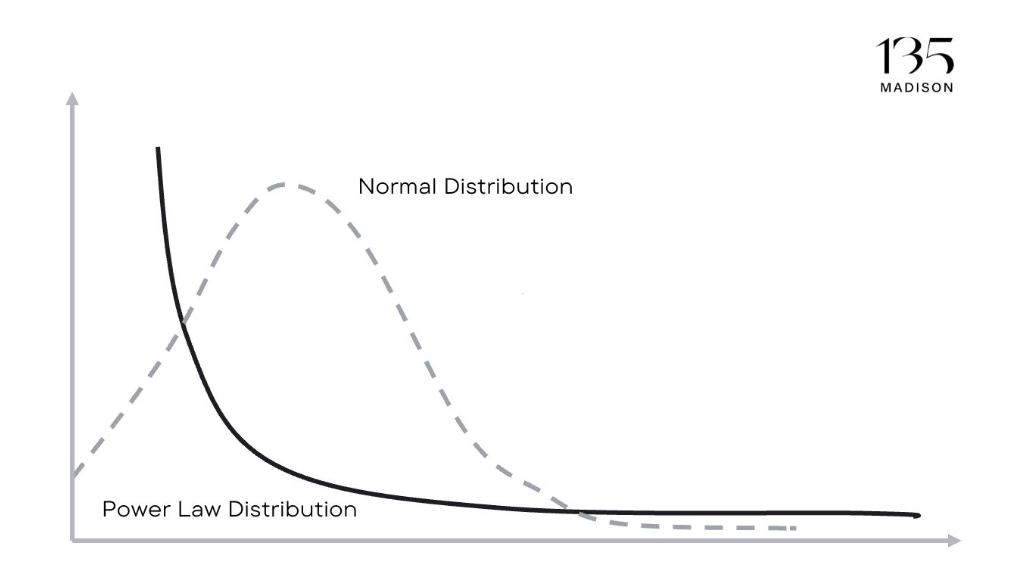

The “Power Law”

Venture capital (VC) investing operates on the “Power Law.”

But what does it mean?

A small number of investments will generate the vast majority of returns in a venture capital portfolio.

In practical terms, out of 100 investments, a few (perhaps even one) will produce outsized returns that could outweigh the total investment made across all projects.

The rest may only achieve moderate success, break even, or fail entirely.

Whether you're investing or seeking funds, the stakes are high!

Securing big VC funding like series A, B, or C is risky, with low chances of success.

VCs are aware of this high-risk environment.

They diversify their investments across various startups, aiming to strike gold with at least one that compensates for the rest.

But there's a big issue often overlooked.

According to the Power Law, half of all VC investments will completely fail, and a quarter will barely break even.

This means that 75% of VC-funded founders endure a challenging journey with minimal financial rewards.

The success stories represent less than 1% of all VC-backed startups and grab the headlines.

The failures, often outnumbering successes, remain largely unspoken.

Raising funds doesn't necessarily improve the chances of success.

For founders, it is win or lose.

VC funding isn't inherently wrong; it's often misinterpreted by founders and overly recommended by funders.

Founders deserve to know the true odds!

They should know that VCs are looking for startups that fit the Power Law dynamic. This means communicating their business's potential for massive scale and disruption.

Being aware that VCs operate under the Power Law can help founders understand the high expectations and the pressure to scale quickly. It also clarifies why VCs might push for aggressive growth strategies.

The potential for a startup to become a VC's "home run" can lead to favorable terms and valuations. However, entrepreneurs need to balance the benefits of VC funding with the dilution of their equity.