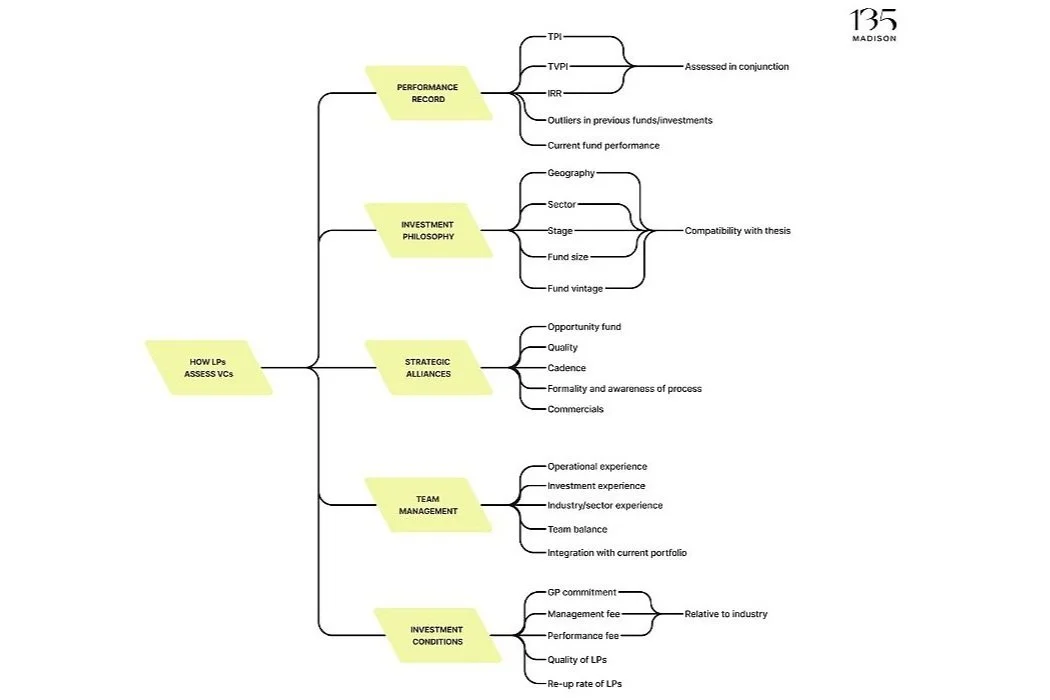

5 key aspects of how LPs assess VC funds

LPs have an approach to evaluating their investments.

→ Performance Record

LPs prioritize a VC fund's history of successful investments. They analyze exit strategies and the returns generated. They look at metrics like Internal Rate of Return (IRR), Total Value to Paid-In (TVPI), and Distributions to Paid-In (DPI) to measure past performance.

→ Investment Philosophy

LPs evaluate the VC's focus on market trends and opportunities, particularly noting the stages, sectors, and sizes of investments.

→ Strategic Alliances

LPs prefer VC funds that demonstrate a formal and efficient approach to managing deals.

→ Team Management

LPs favor teams that are well-regarded by founders and have a history of successful collaboration.

→ Investment Conditions

LPs look for terms that indicate a long-term, mutually beneficial relationship.