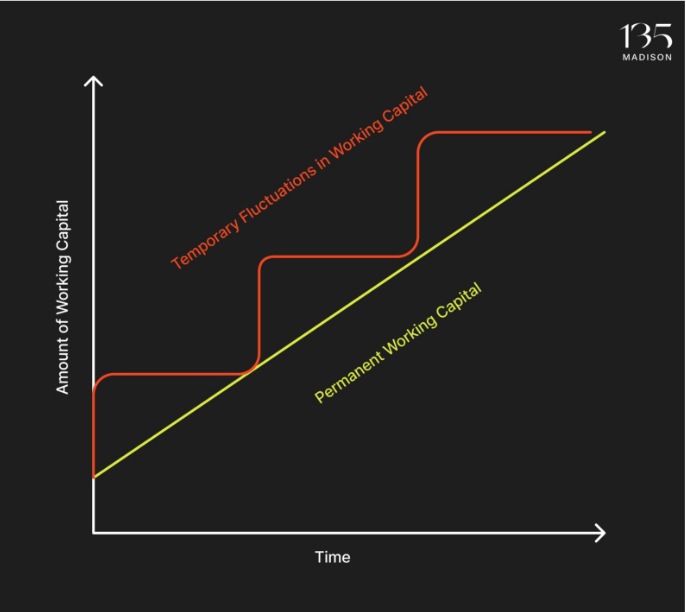

Permanent vs. Temporary working capital

Manage your permanent and temporary working capital to fuel growth and avoid common pitfalls.

Permanent working capital is essential for daily operations.

You need more if accounts receivable are slow.

For permanent capital:

✔️ Get long-term financing

✔️ Speed up cash conversion

✔️ Use collection tools

Temporary working capital helps with business ups and downs.

For temporary needs:

✔️ Keep short-term funds handy

✔️ Predict seasonal trends

✔️ Use just-in-time inventory

Mixing both can lead to:

❌ Wasting money on advertising, not enough for core tasks

❌ Not using extra funds, missing seasonal opportunities

❌ Confusion in critical business decisions